Our Mission

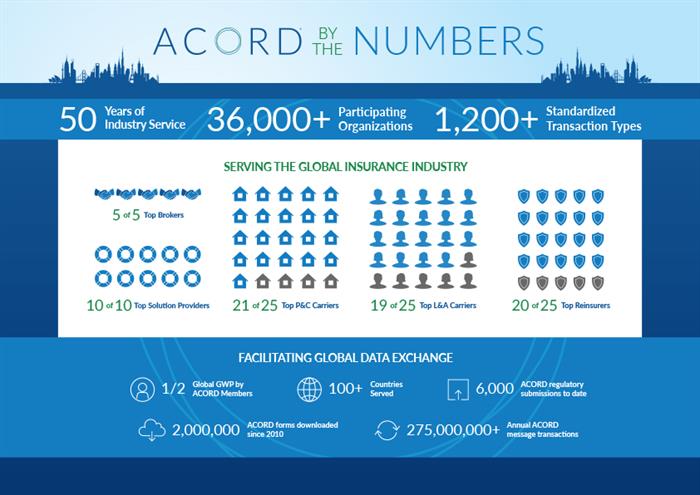

ACORD is a non-profit, industry-owned organization. For 50 years, ACORD has enabled the success of the global insurance industry by facilitating the flow of data and information across all insurance stakeholders through relevant and timely data standards.

ACORD moves the global insurance industry forward by encouraging and facilitating global information, enabling improved efficiency, and implementing effective, strategic positioning.

About ACORD

ACORD (Association for Cooperative Operations Research and Development) is the global standards-setting body for the insurance and related financial services industries. ACORD facilitates fast, accurate data exchange and efficient workflows through the development of electronic standards, standardized forms, and tools to support their use. ACORD members worldwide include thousands of insurance and reinsurance companies, agents and brokers, software providers, financial services organizations and industry associations. ACORD maintains offices in New York and London.

Since 1970, ACORD has been an industry leader in identifying ways to help its members make improvements across the insurance value chain. Implementing ACORD Standards improves data quality and flow, increase efficiency, and realize billion-dollar savings to the global insurance industry.

ACORD engages more than 36,000 participating organizations spanning more than 100 countries, including insurance and reinsurance companies, agents and brokers, software providers, financial services organizations and industry associations. With the tools and resources provided by ACORD, our members are equipped to address current business and technology imperatives while influencing and shaping the future.

Our Values

Throughout our more than 50 years of service, we at ACORD have upheld a high ethical standard. To best serve the ACORD community, we are committed to engaging with members and participants through respect, integrity, and passion for our work. We believe that it is important that we continue to grow alongside the insurance industry.

ACORD nurtures a culture of collaboration, communication, and service. These core values allow us to not only drive improvements for our members, but to consistently raise the bar for ourselves and the industry.